Consulting Value IndexTM

Dominic Barton calls McKinsey the leadership factory.

Barton cites the statistic: 359 McKinsey alumni run +1$bn companies.

Media quotes this unverified “leadership factory” phrase.

We measured McKinsey on its ability to produce leaders.

We audited the Fortune 1,000.

We found this McKinsey statement to be untrue.

McKinsey is not the leadership factory for the Fortune 1,000.

Leadership as defined by absolute number of CEOs: McKinsey wins

Of the 1,000 largest public companies in the USA, McKinsey alumni are CEOs of 26 companies: more than any other consulting or audit firm. Arthur Andersen alumni, the now defunct audit firm, run 23 of the 1,000 largest public companies in the US.

Yes, McKinsey’s greatest competition for being a CEO factory is a ghost.

To accept this statistic as being the ultimate measure of a leadership factory is the equivalent of accepting the absurd statement that Mexico is wealthier than Switzerland since the former has a GDP PPP of $2.09T versus the latter’s $0.43T.

Leadership as defined by per capita number of CEOs: Bain wins

On a per capita basis, which is a more accurate measure of a CEO factory, McKinsey produces 1.53 CEOs for every 1,000 employees. Bain produces 2.04 CEOs and BCG a fairly lackluster 0.93. Bain needs fewer consultants to produce the same number of CEOs as McKinsey, or said differently, Bain is ~33% more efficient than McKinsey at producing CEOs.

If you plan to be a CEO one day, the probability is higher for Bain alumni.

To accept this statistic as being the ultimate measure of a leadership factory is the equivalent of accepting the absurd statement that Afghanistan is safer than Canada since the former has 401 policeman per 100,000 people versus the latter’s 202. As we can see in this example, being efficient is not the same as performing well.

Leadership as defined by shareholder value created by CEOs: PwC Audit wins

The absolute and per capita numbers of CEOs are not the most appropriate metrics. We have to look at how well these CEO’s do their jobs. The most important metric for a listed company is, therefore, how much shareholder value does the CEO create during his/her tenure.

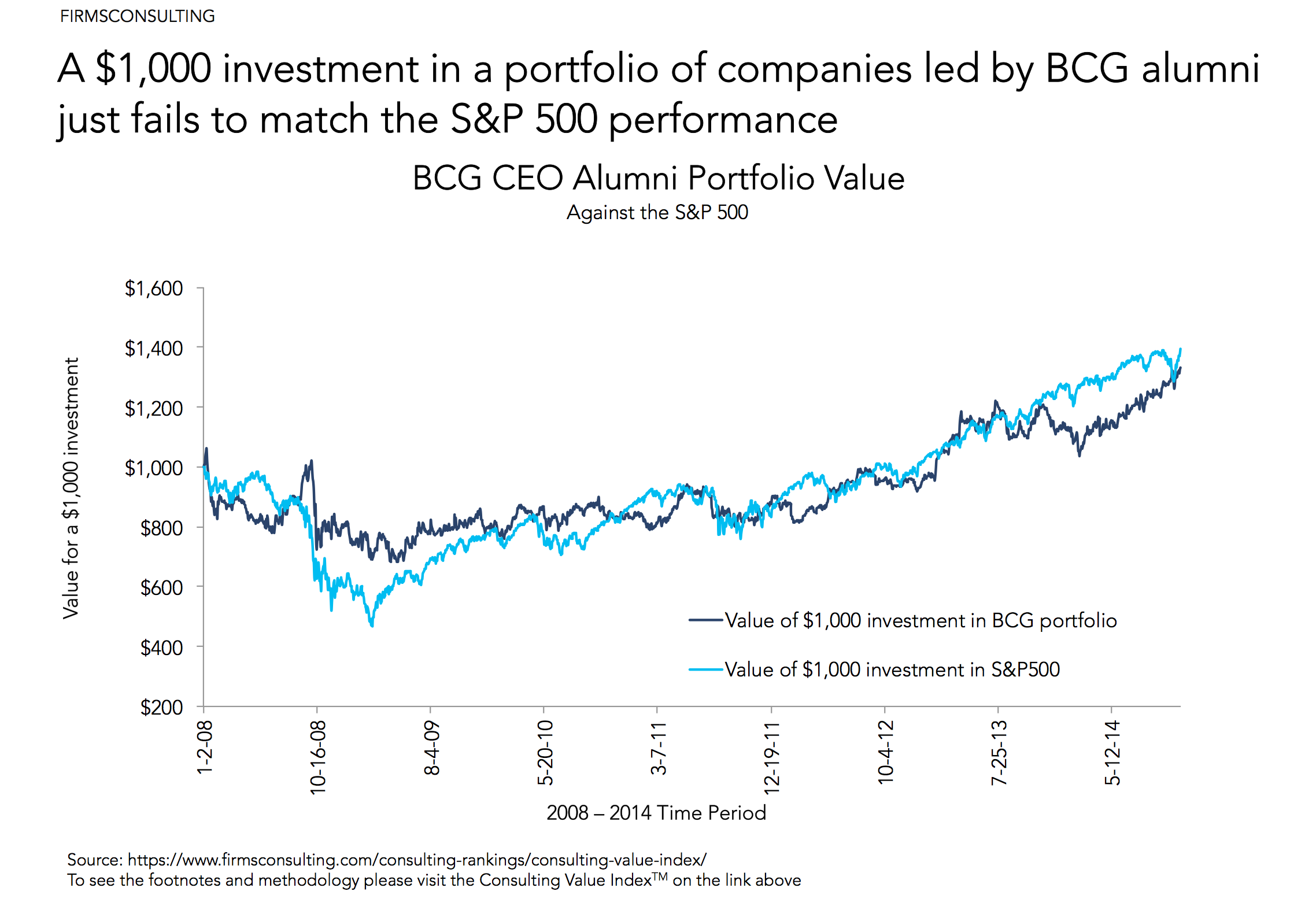

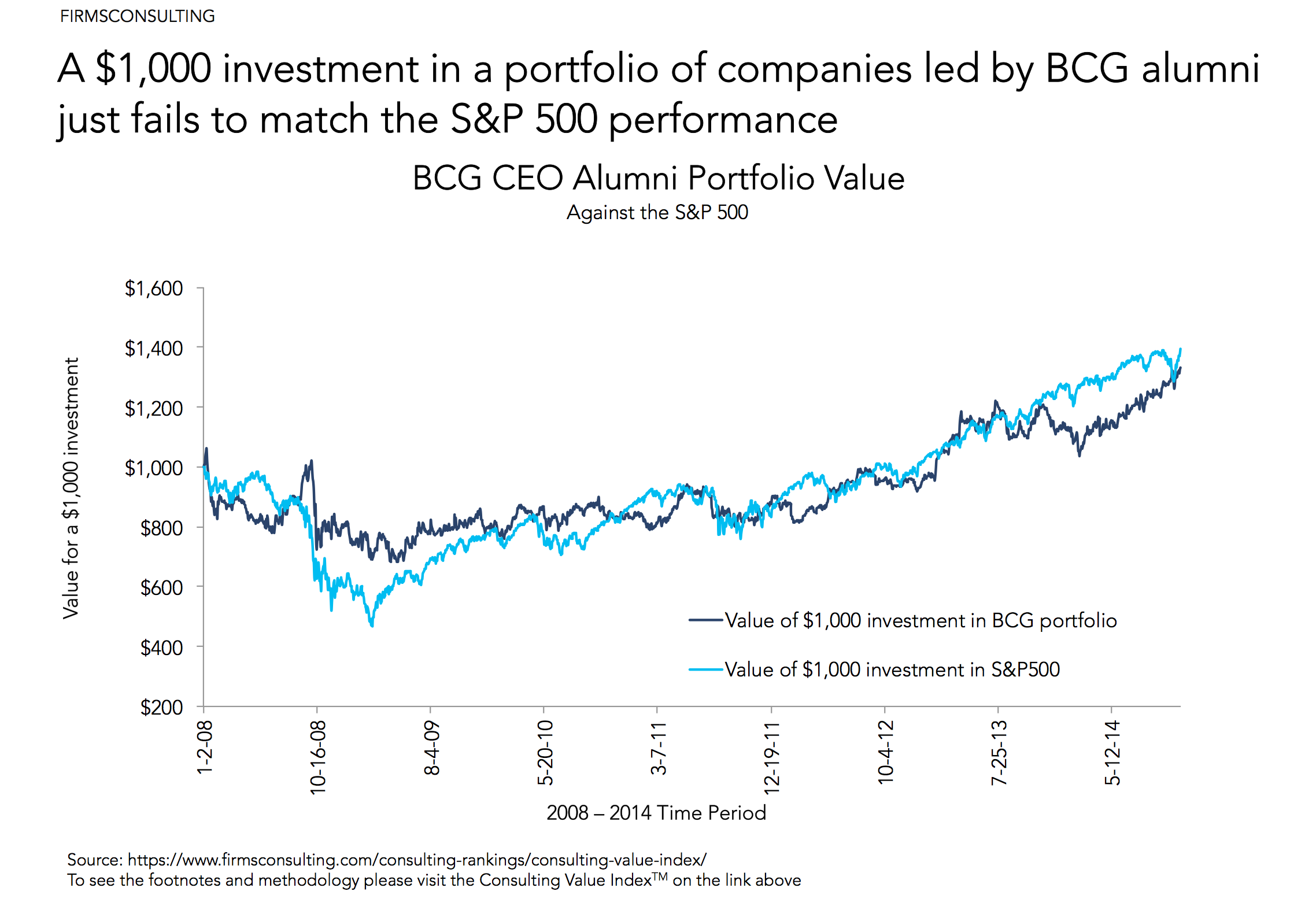

We clustered all the companies run by McKinsey alumni into one share index to calculate if investing in a portfolio of “McKinsey” alumni-led companies generated greater returns than investing in the S&P 500 or a “Bain” portfolio. Each portfolio is a Consulting Value IndexTM

We created Consulting Value IndexTM portfolios for all firms with >7 alumni CEOs:

McKinsey

BCG

Bain

PwC Audit

E&Y Audit

Deloitte Audit

KPMG Audit

Arthur Anderson Audit

PwC Audit is the undisputed winner. While it is harder to become a CEO when working at PwC Audit & Tax, those who do become CEO perform the best. If you plan to be a CEO one day who earns a lot of money due to impressive share price growth, the probability is higher for PwC Audit alumni.

If you invested $1,000 in the PwC Audit portfolio, you would have a minimum $2,121 today versus the minimum $1,395 you would receive from investing in the S&P 500. PwC Audit alumni beat the S&P 500 by 52% for the period 2 Jan 2008 to end of October 2014.

The McKinsey portfolio trailed the S&P 500 by 24.6% in the same period. In other words, despite all of McKinsey’s so-called “leadership factory” skills, their CEOs do not lead the market.

Bain is the undisputed loser among strategy firms. A Bain portfolio consists of 11 alumni CEOs, 2.04 CEOs per capita and trails the S&P 500 by 33.2% for the period ended 2008 to 2014.

The McKinsey statement is untrue because they have incorrectly defined leadership. Leadership is defined by the CEO’s performance and not his/her title. Share value appreciation is used as the main metric of being a leader since this is the most important metric to shareholders; CEO’s who destroy shareholder value are not likely to be leading anything for very long.

It would be correct for McKinsey to call itself a CEO factory because the title for leadership factory goes to PwC Audit.

We openly admit that being a great leader is about more that just share price performance. Leading a great company, executing a grand vision, building a team of exceptional peers and creating value depends on many skills that are terribly difficult to measure: vision, gravitas, authenticity, mentoring, long-term planning, recruiting, motivating and more. Investors are also not the only stakeholders and certainly not the most important. Great CEOs need to balance the needs of regulators, clients, employees, suppliers and communities.

That said, a CEO can be amazing at all of the above, but if he does not create some form of shareholder value, he will be dismissed.

We wanted the ranking to be as objective as possible, so we have measured the one thing that drives the majority of CEO hiring, firing and compensation decisions. The day may very well come when intangibles can be measured with decimal point precision, yet until that time we will need to add intangibles as supplementary data to inform the context of the ranking. Moreover, until shareholder value is no longer the main measure of performance, we will continue using this approach or a modified version of it.

Yet, a bigger insight is that the so-called big three strategy firms may produce more CEOs in absolute terms, yet they do not do really well. Is this the halo effect? Are boards hiring ex-Big 3 alumni since they assume these executives will perform better even when the evidence states otherwise? Shareholders need to be more demanding of their boards and use a Consulting Value IndexTM type analyses.

The other insight is the strong performance of the audit alumni. Maybe headhunters need to rethink their strategies for finding prospective CEOs?

These are two exhibits of the minimum value created in all portfolios against the performance of the S&P 500.

This is the absolute number of CEO alumni by each consulting and audit firm for the 1,000 largest US public companies.

This is the per capita number of CEO alumni by each consulting and audit firm for the 1,000 largest US public companies.

These four exhibits show the consistent manner in which the Big-3 portfolios underperform the S&P 500 and PwC Audit.

This is the database of the CEOs used in the analyses:

Key Insights

PwC Audit #1: When developing the hypotheses and analyses for this study, we did not expect PwC Audit to come in at #1. We expected Bain to do so since Bain was the only consulting firm which tracked client share prices on its website. We naturally assumed Bain’s analyses were correct. The deep insight is that the best leaders are not where we would expect to find them.

Advising versus Doing: While McKinsey, Bain and BCG consultants are exceptional at advising clients on strategy and operations issues, they do not perform very well when they switch sides to take the CEO role. The opposite seems to be true for the audit firms. Audit and tax partners may have oversight of management issues during their partnership tenures, yet they do not actively advise clients on this. Yet, they do very well when placed in the CEO role.

KPMG Audit is an anomaly. In future versions of the Consulting Value IndexTM we will examine why this is the case and see if KPMG’s position changes as we improve the methodology. We will do the same for McKinsey, Bain and BCG.

Arthur Anderson: Scandals have a very short half-life. In this image obsessed world Arthur Anderson alumni have shrugged off any problems with the brand and done very well as measured by the number of CEOs and their performance.

Arthur Andersen may be dead, but it is very much alive as an influence on corporate America. Having done nothing since 2002 and despite all the negative press they are still McKinsey’s greatest competition for running corporate America. Imagine where Arthur Anderson could have been today if it had survived?

BCG: The performance of BCG tends to be average. It is somewhat in the middle in terms of absolute CEOs produced, per capital CEO’s produced and shareholder value creation. In just about everything it does, BCG has perfected the art of being strong but not exceptional. This is a not an insult to BCG. It is risky to strike out and while the market is growing it makes sense to grow with the market.

Audit Practices: The audit arms of audit firms deserve more respect as leadership factories. Audit firms are CEO factory powerhouses in absolute terms with 59 alumni as CEOs. PwC Audit has 21 alumni CEOs that is far ahead of Deloitte Audit’s 10 CEOs. Given Deloitte’s enormous advertising and strong consulting presence, it was expected they would do much better. Deloitte Audit produces fewer CEOs than every audit firm in the US despite having the most number of employees at ~210,000 worldwide.

The consulting practices of the audit firms are vastly overrated. Only Deloitte S&O has any CEO alumni: just one. In other words, you have a far better chance of being a CEO if you joined the audit side of the audit firms.

Accenture has close to 4 times the number of employees as Arthur Anderson had when it collapsed but produces almost 8 times fewer CEOs.

McKinsey: McKinsey CEOs tend to run very small companies. Only 26 McKinsey alumni run companies in the top 500 of the 1,000 largest listed US companies.

Given that the US economy is between 17% and 20% of global GDP that, on an optimistic basis, translates into (100% / 20%) x 26 = 130 McKinsey alumni running foreign companies equivalent in size to the Fortune 500.

However, the vast majority of McKinsey alumni are based in the US, thereby reducing this number by up to 50%, leading to 65. Therefore, 359 – 26 – 65 = 268 McKinsey alums must be running smaller listed US companies and medium to large private companies.

Bain: Given the Bain portfolio’s miserable performance, we can see why they would not conduct this analysis. Yet, Bain’s own client shareholder exhibit at the bottom of the page is deliberately misleading. Bain has performed a similar analysis as we have and calculated how much shareholder value Bain clients have created versus the S&P 500.

Yet, have you ever seen a major listed company that uses just one consulting firm for all its needs? Therefore, how does Bain know McKinsey or BCG did not create the shareholder value for the client? For all we know, it was the implementation teams from rival firms implementing the Bain strategy who created the value.

Rather than displaying a misleading analysis, Bain should remove it.

Acquisitions: Booz Allen Hamilton (BAH) has 5 CEOs in the list and Oliver Wyman has four. Monitor produced just 2 CEOs. Maybe Deloitte should have bought Oliver Wyman?

The Fortune 1,000 was used as the starting point. Private, acquired, delisted and mutual fund companies where removed from the list. This brought us to 920 companies. Non-US domiciled firms where removed from the list. We added in the 80 next largest listed companies to compensate for the eliminated US firms, until we had a list of 1,000 companies. The list covers close to 30% of the global stock market capitalization and the majority of US market capitalization.

CEOs who previously worked as independent consultants or for very small consulting firms are not included in this sample.

All data is extracted from Datastream and Worldscope to calculate the daily company share price movement, and market capitalization movement. We did not examine the share price movement over the entire duration of the CEOs tenure since this would result in incomparable tenures between CEOs. We removed changes due to the improvement in the overall sector. The ranking is interested in the current performance of the portfolio against the current S&P 500 performance. Future revisions to the Consulting Value Index methodology may consider calculating economic profit, pricing in optionality and/or the cost of unethical decisions.

We collected biographical data on when the CEO was appointed, the sector of the company, location of the company, gender of the CEO, education, and scandals/newsworthy items to control for outliers.

The online bios and regulatory filings of each firm where used to verify the CEOs employment history. The academic credentials of one CEO did not match those provided by his purported graduating school.

Booz & Co alumni are listed as Booz Allen & Hamilton alumni. It was not always clear if they belonged to the government or strategy side of the business so they were all grouped as BAH for consistency. They could conceivably be listed as Strategy& alumni.

All share portfolios use historical market closing share prices for the day and are weighted using current market capitalizations.

Where a CEO worked for more than one firm ranked, such as McKinsey and Arthur Anderson for example, all firms received equal credit.

The consulting alumni of the audit firms are counted separately. For example, Deloitte S&O is counted as a different list from Deloitte. Braxton alumni are counted as part of Deloitte S&O.

The consulting alumni of Arthur Anderson are counted as part of Accenture.

All share portfolios use historical market closing share prices for the day and are weighted using current market capitalizations.

Foreign listed companies were excluded since they are subject to regulations, regulators and scrutiny that may not be as rigorous as in the US.

Private companies were excluded since they tend to have uncertain governance rigor and are subject to regulations, regulators and scrutiny that may not be as rigorous as for listed companies.